The current situation and development trend of gear processing equipment (Attachment: Agenda of the 7th High-Precision Gear Manufacturing Technology Seminar)

2025-02-28

1. High Precision and Machining Technology

• Micrometer/nanometer precision requirements: The increasing demands for noise control, transmission efficiency, and lifespan of gears in fields such as new energy vehicles, robotics, and aerospace are driving the development of gear manufacturing equipment towards machining (such as hard gear surface grinding and honing).

• High-speed dry cutting technology: Using coated tools, ceramic materials, and high-speed cutting processes to reduce the use of cutting fluid and improve processing efficiency (such as the high-speed dry hobbing machine from Liebherr in Germany).

2. Intelligent and Digital Transformation

• Digital twins and real-time monitoring: Real-time monitoring of parameters such as temperature and vibration during the gear machining process through sensors and AI algorithms to optimize machining paths and predict tool wear (such as the adaptive control function of Siemens CNC systems).

• Flexible production lines: Supporting multi-variety and small-batch production modes, such as modular machine tool design for quick switching of gear types (such as automotive transmission gears and robot joint gears).

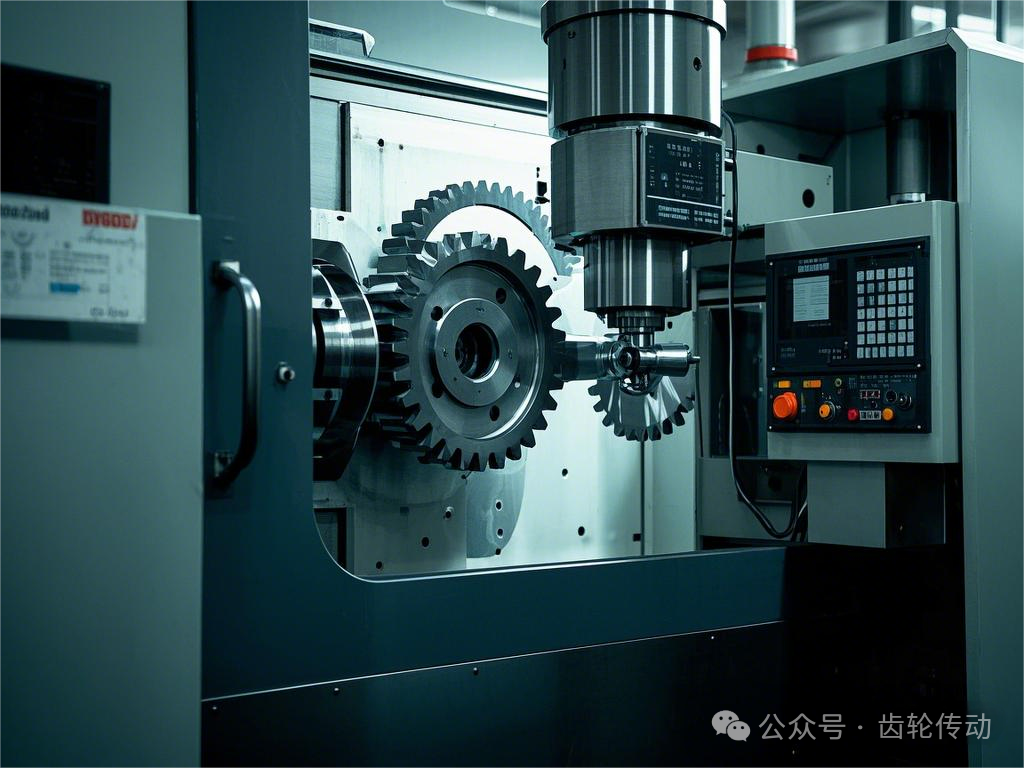

3. Compound Machining and Process Integration

• Integrated turning, milling and grinding equipment: Integrating hobbing, milling, and grinding processes into one machine tool to reduce the number of clamping times and improve processing consistency (such as the RZ series grinding machine from GF Machining Solutions in Switzerland).

• Online detection and closed-loop control: Embedding a measurement system in the machining process to correct errors in real-time and ensure gear precision (such as Klingelnberg's KIMoS system).

4. Green Manufacturing and Sustainable Development

• Dry cutting and minimum quantity lubrication (MQL): Reducing cutting fluid pollution and energy consumption (Mitsubishi's dry hobbing technology in Japan has achieved zero emissions).

• Lightweight and energy-saving design: Using lightweight structures such as carbon fiber composite materials to reduce the machine tool's own energy consumption.

• Breakthrough in core component technologies: such as high-precision spindles, CNC systems (Huazhong CNC, Guangzhou CNC, etc., are gradually replacing imports), and gear measuring instruments.

• Upstream and downstream collaborative innovation: Joint development of customized gear processing solutions with material suppliers (such as gear steel) and automotive manufacturers.

1. Key Technologies and Core Components Rely on Imports

• CNC systems and functional components: Five-axis linkage CNC systems and high-precision encoders still rely on foreign brands such as Siemens and Fanuc; domestic systems have a gap in stability and response speed.

• Tools and coating technology: Gear tools (such as cemented carbide hobs and CBN grinding wheels) mainly rely on companies such as German Walter and Gleason in the United States.

2. Basic Materials and Process Bottlenecks

• Insufficient performance of gear materials: Domestic gear steel lags behind Kobe Steel in Japan and SSAB in Sweden in terms of purity and heat treatment deformation control, affecting gear fatigue life.

• Insufficient process experience accumulation: Optimization of grinding and carburizing and quenching process parameters relies on long-term data accumulation, and domestic companies lack a systematic database.

3. Insufficient R&D Investment and Innovation Capability

• Low R&D investment by enterprises: The R&D investment of domestic leading enterprises generally accounts for less than 5% of revenue, while foreign enterprises (such as Gleason) have consistently maintained 8%-10%.

• Low efficiency of industry-academia-research transformation: Gear theoretical research in universities (such as meshing dynamics) is disconnected from the actual needs of enterprises, and the transformation cycle of achievements is long.

4. Talent Shortage

Shortage of compound technical talents: There is a shortage of engineers who simultaneously master gear design, CNC programming, and AI algorithms, which restricts intelligent upgrades.

Skill worker gap: Traditional gear machine tool operators are aging, and the new generation of workers lacks the ability to operate and maintain digital equipment.

5. Market Competition and Low Brand Recognition

• Market monopolized by foreign capital: The gear processing equipment market (such as large marine gears and high-precision robot joint gears) is still dominated by European and American companies such as Gleason and Liebherr.

• Insufficient trust in domestic equipment: Although domestic enterprises (such as Qin Chuan Machine Tool and Nanjing Second Machine Tool Plant) have made breakthroughs in the mid-range market, customers still prefer imported equipment.

6. International Environment and Supply Chain Risks

• Technological blockade and export controls: Europe and the United States have imposed export restrictions on gear measuring instruments and machine tools (such as the US ban on the sale of some grinding machines to China).

• Vulnerability of the global supply chain: After the epidemic, international logistics costs have risen, and the delivery cycle of key components (such as Bosch Rexroth guides) has been extended.

Other Information